Cash Flow management is important.

To operate a healthy business, pay bills, purchase assets, and make a profit, small business owners should regularly track Cash Flow metrics.

I am a Corporate Controller in a large organization today, but I have worked in small businesses with less than 5 employees. And I have worked in small businesses experiencing rapid growth. Big and small, what I see is the continuous drive to understand, measure, and improve Cash Flow.

Businesses fail. Searching anywhere shows 80-90% of small businesses fail within 5 years (20% within 1 year). Most of the time poor cash management and a poor understanding of Cash Flow is the problem.

Let’s start understanding Cash Flow with 2 basic metrics easy to implement today.

Number of days outstanding metrics:

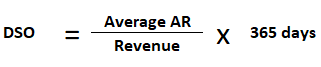

Days sales outstanding (DSO)

How long does it take you to convert your credit sales into cash?

A lower DSO is preferred. It means that you are converting your credit sales into cash quickly. And generating positive cash flow allows you to reduce risk and sustain long-term growth.

Calculate your DSO like this:

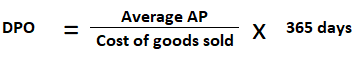

Days payable outstanding (DPO)

How long can you wait before you have to pay your bills?

Higher DPO is preferred. It means that you have negotiated well with your suppliers and you are holding onto your cash longer. And again, generating positive cash flow allows you to reduce risk and sustain long-term growth.

Calculate your DPO like this:

Knowledge is power. Cash Flow optimization, monitoring, and improving these 2 metrics will give you early insight and the opportunity to adapt within your business.

Stay tuned for actionable ways to improve each of these metrics!